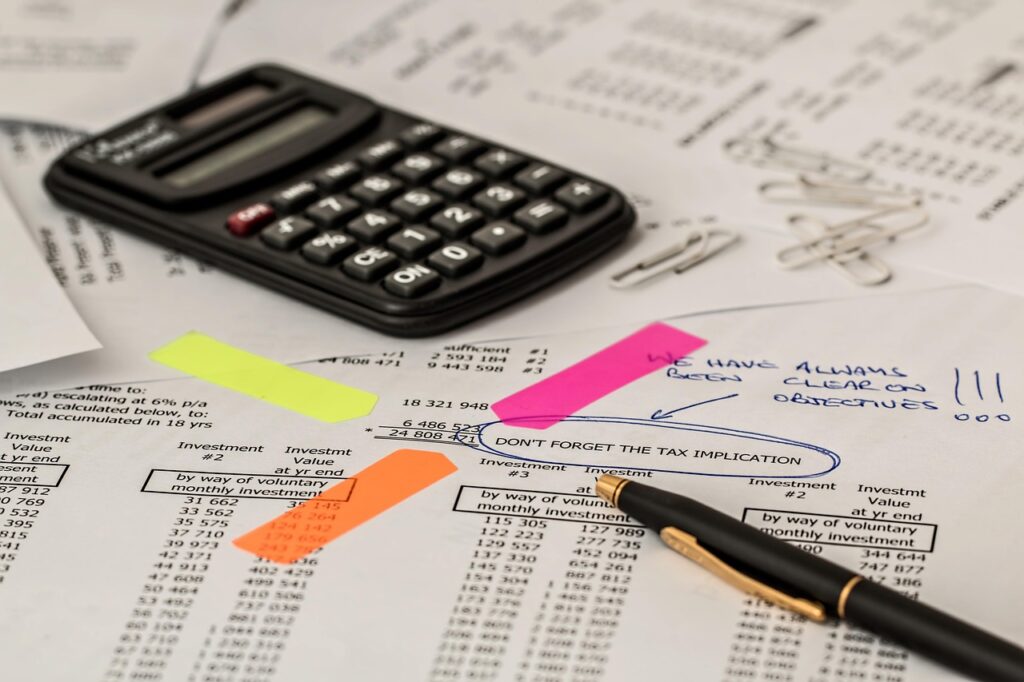

Does your company have tax problems? Tax accounting may either ruin or improve your financial situation. Your tax accountant’s knowledge will have significant effects on your organization’s financial health as well as its standing with regulatory agencies. Accounting companies are well-equipped to assist you with all of your accounting and tax requirements in a cost-effective and efficient manner, thanks to the most recent techniques and best practice tactics.

Tax returns are one of the many services offered by tax accountancy companies. Sydney’s tax accountants are unrivaled in terms of their credentials, and they provide a wide range of tax services, including online tax, tax returns, and tax planning, among other crucial tax-related services. Tax accountants assist business owners with year-end procedures as professionals. Furthermore, you will provide tax advice to your client regarding the administration of tax flow and income tax returns.

A professional tax counselor can help you with the following:

Preparation of income tax returns and lodging of trusts, superannuation, and firms.

Capital allowances, depreciation and gearing, and rental properties

The land tax.

They also address additional tax-related topics, such as:

- Calculation of payroll taxes

- Workover

- The stamp tax

- Tax on capital gains

- Taxes on fringe benefits

- Preparation and submission of business activity statements and installment activity statements

The tax accountant must be knowledgeable about the tax regulations and accounting methods used in your jurisdiction. A formal request must be made in advance for your business to switch accounting methods. Before you may switch from one approach to another, you must first recompute your taxable income accurately.

In tax accounting, a professional must be skilled in carefully analyzing and applying the relevant tax laws, regulations, administrative rulings, and provisions. It is best to use online experts or conduct these procedures internally. For any organization, adherence to state rules and regulations is still essential. You may believe that maintaining an in-house tax accountant is less expensive, but hiring an independent accounting business will help you handle tax matters and lower your tax liabilities.

Which accounting method do you favor?

The two main accounting methods are the cash basis and the accrual basis. The company will use the most suitable approach for its tax accounting plan. Regardless of the technique you choose, it’s crucial that you use it consistently and properly to avoid breaking the law. You are certainly missing out on the advantages that come with using a Tax Accountant Sydney if you are not already doing so.